Recall from Part 1 of this post that I was comparing two papers written by Dr Sandy Bond on the effects of CPTs on property values:

Note: 650 feet ~= 200 meters

Note: 985 feet ~= 300 meters

Note: 1310 feet ~= 400 meters

Both papers state that negative media and, perceptions and sentiments of residents and buyers may play a more important role than what the governments say ("inconclusive"). The both state that property prices decreased after CPTs were built around the neighborhood.

The papers diverge on how much property values decrease by and the distance from CPTs. In summary:

In NZ - Average 15% decrease until about 300 meters.

In FL - Average 2% decrease until about 200 meters.

How to apply this to the neighborhood of 1080 Mango Ave?

I think this Sunnyvale community more closely resembles NZ than FL, mostly because of taxation levels and property values. FL has no state income tax (except dividends and interests income) while CA's state income tax routinely puts most people in the AMT category, lets just say 10% for simplicity. Orange County FL's sales tax is 6.5% while Sunnyvale's is 9.25%.

According to the census report for Orange County, FL:

Median value of owner-occupied housing units, 2000 = $107,500

Median household income, 2008 = $50,674

Ratio of median value to median income is 2:1.

According to the censes report for Santa Clara County, CA:

Median value of owner-occupied housing units, 2000 = $446,400

Median household income, 2008 = $88,525

Ration of median value to median income is 5:1.

According to Florida Department of Revenue, a $400,000 property will pay about $1,250 in property tax.

Property tax rate in Santa Clara County is 0.8%, so a $400,000 property will pay about $4,000 in property tax.

It will take a family much longer pay off its house in Santa Clara County compared to in Orange County.

In NZ, income tax is around 36% but General Sales Tax is around 15%. Average property tax in NZ is $1000 to $2000. (see article)

So in short, people in NZ bears similar tax burden as the people in California and it will take a family just as long to pay off its property. Therefore, property values in Sunnyvale should decrease by the same percentage and using the same distance as the NZ case study.

In NZ - Average 15% decrease until about 300 meters.

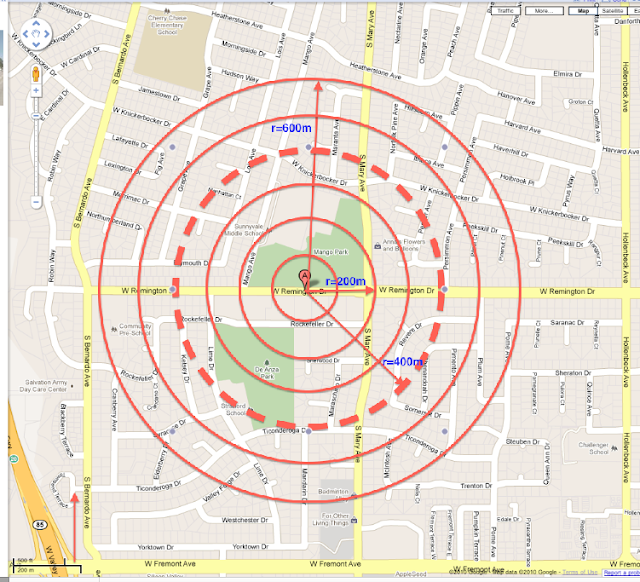

Here is a map of the neighborhood around the SMS CPT:

What do we know about this area?

There are about 100 houses within the radius of 300 meters from the SMS CPT as shown in the map.

Average house price is $700K. (This is a low estimation since there are some pretty nice houses along W. Knickerbocker and Rockefeller area.)

The City of Sunnyvale will lose not only income from property taxes, but also taxes on the rental income of the two apartment buildings right across from the CPT.

But are we sure the property values will decrease because of the SMS CPT?

Dr Sandy Bond's papers clearly state that.

Also, here are some letters from realtors from Danville's fight against the siting of a CPT in their neighborhood:

http://nocelltower.info/info.php#Norm_Stanley_Expert_Opinion - disclosure issue and detrimental effect on value

http://nocelltower.info/info.php#pisenti - decrease by 6-10%

http://nocelltower.info/info.php#Nicole_Tucker_Agent_Letter - could decrease in excess of 10%

http://nocelltower.info/info.php#Ron_Gatti_Letter - negative impact on value

http://nocelltower.info/info.php#BJ_Diehl - disclosure and appraisal issues

http://nocelltower.info/info.php#Letter_from_Dana_Weiler - hurt value, disclosure issue

Residents in Glendale, California had letters from realtors citing almost 25% decrease. But letters could not be found online.

So, let us ask ourselves again, is the $25K offerred by AT&T going to add to the City of Sunnyvale's overall income?

I think the answer is a resounding NO! Again, when you look at the big picture, things just don't look so rosy afterall.

This is something the City Planner and City Council should think about very carefully about before signing over a multi-year lease to AT&T.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.